RTGS / ACH Participant Interface Application

.jpg)

.jpg)

STP is an initiative used by companies in the financial world to optimize the speed at which transactions are being processed. It is done by electronically connecting participant’s internal systems with Central Bank’s RTGS System and hence there won’t be a need to enter same pieces of information repeatedly.

STP will increase the efficiency level at participant’s end due to shortened processing cycles. It will also reduce operational errors and moreover curtailed operating expenses because of not reentering transactions in multiple systems. STP is beneficial in decreasing settlement risk. This is because of shortening transaction-related processing time will increase the probability that a payment contract /agreement will actually settled on time. Since the inception of RTGS in many countries, enrollment of direct participants is growing and volume of transactions is also increasing. It has been foreseen that in future, volume of transaction will increase dramatically. This growing volume forcing banks to deploy a gateway application between Core Banking System and Central Bank to improving performance of financial messages communications channels.

Our Solution

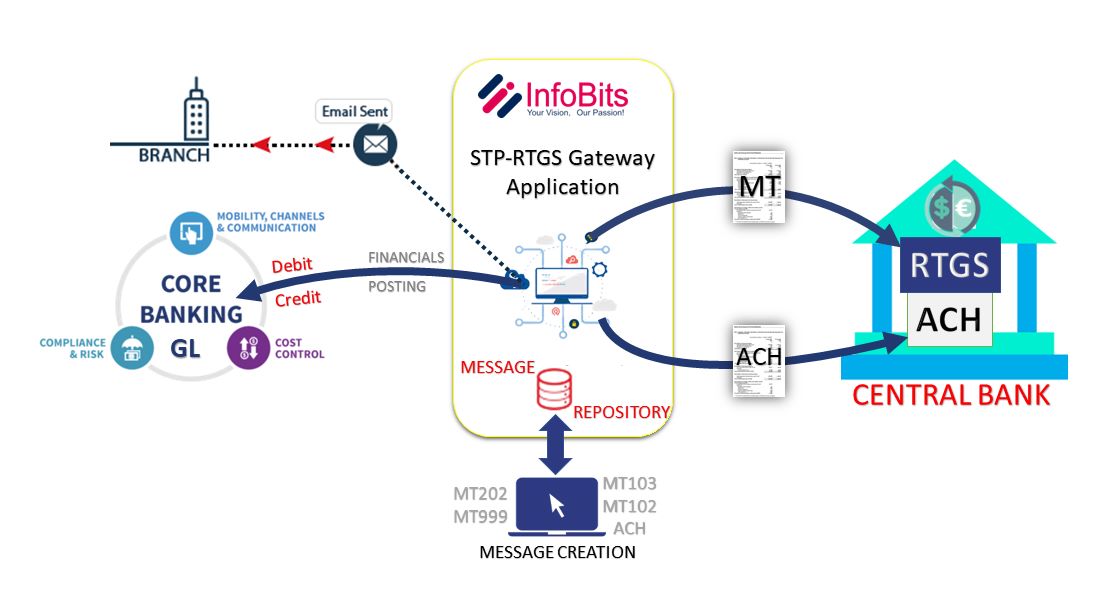

InfoBits STP - RTGS Gateway ApplicationAs “Straight through Processing (STP)” implementation, InfoBits STP - RTGS Gateway Application provides the integration between banking software running at Bank’s site and RTGS (Real-time Gross Settlement) System running at Central Bank. It is the gateway between Core Banking System and Central Bank.

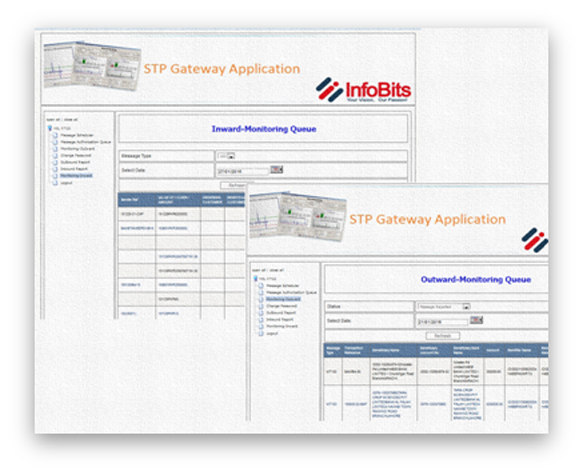

InfoBits STP - RTGS Gateway Application is a middleware system between Core Banking and Central Bank which will act as local STP RTGS solution for MT103/MT102/MT202/MT104 and other financial messages. It will also be a repository of financial messages exchanged between Central Bank and participating bank and provide reports for audit and reconciliation.

InfoBits STP - RTGS Gateway Application consist three main modules: