Open Banking: What it Means for Consumers and Businesses?

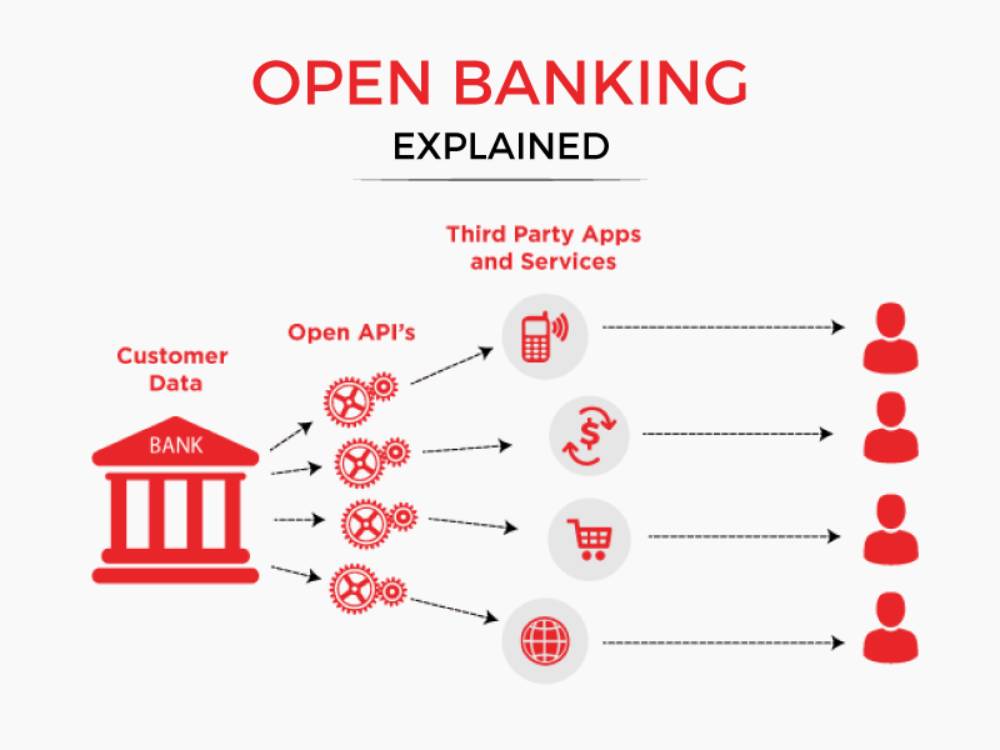

The financial landscape is changing with open banking being introduced. Open banking offers convenience, is budget-friendly, and offers better control not only for consumers but also for businesses. In the blog below, we will talk about what open banking can do for customers and businesses.

Open Banking for Consumers

Consumers can benefit from open banking in numerous ways, as it helps empower individuals to manage their finances. The secure access to their banking data, being provided to them, can help them in the following ways:

- The management of finance becomes centralised. Especially with applications such as Yolt, users can have multiple banking apps at the same time, which can help simplify their budgeting and financial budgeting.

- The access to credit also improves because lenders can asses a customers dependability by anaylsing their transaction data accurately. This can help speed up the process of loan approvals further.

- Tailored insights and other budgeting advice can be given to customers through AI-driven apps. Better financial management can be achieved with these personalised financial tools.

Open Banking for Business

Like customers, businesses can also gain a lot from open banking. Usually, small and medium-sized enterprises have more advantages, such as:

- Payments become cost-effective. This can be done through services such as GoCardless Instant Bank Pay, which allows businesses to receive payments directly from a customer's bank account. This, as a result, reduces the transaction fees often incurred in traditional transactions.

- Operations are streamlined when open banking is integrated with accounting platforms. This makes real-time cash flow management easier and effective with enhanced efficiency in operations.

- Customer experience improves because open banking allows businesses to analyse customer spending patterns. This facilitates businesses in providing personalised services and financial products.

Trusted and Transparent Sharing of Data

With open banking, you won’t have to worry about your data going into the wrong hands. This is because open banking's core is safety. The design of open banking is such that it follows the strict regulations that are set by authorities. Further, you are in charge of who gets access to your data and for how long. This sort of advanced protection in the form of encryption and secure authentication helps keep your data safe from fraud and any kind of misuse.

Bottom Line

In the end, we can state that open banking can open many doors for businesses and assist consumers in many ways by making their financial budgeting easier. The ecosystem will continue to evolve, and with open banking a we can help achieve the aim of a more connected, efficient and financially secure future for everyone.